You Are Not Entitled to Retirement

I have this pet peeve, and you may not like it when I tell you what it is.

When I’m out and people ask me what I do, I normally tell them “I’m a Financial Advisor, I help people plan their retirement”. I often hear in response something along the lines of “oh I’m going to retire in 5 years” (or some other short period of time). I’m genuinely happy for these people because they’re so excited to be able to stop working and enjoy life.

However, being a Financial Advisor, I have a few questions for them. I often ask these people, while trying to be as tactful as possible, “do you know how much you need to have saved to maintain your lifestyle in retirement”, “are you currently on track to reach that amount” and “have you checked the Social Security’s website to see what you’ll receive from them”?

The answers to these questions, more often than not, are “no”, “no” and “no”. This drives me absolutely nuts!

The reason this bothers me so much is because so many people believe that just because they reach a certain age or have gotten to a certain point in their life, they can retire and live the retirement of their dreams. Retirement does not just happen! You are not entitled to retirement just because you reach a certain age! You have to save, prepare and plan for retirement!

Now I know many of you will be quite upset at reading that, but let me explain. You ARE entitled to Social Security Benefits. However, you are NOT entitled to retirement!

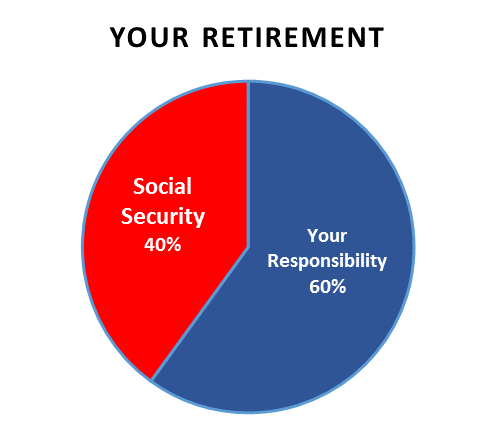

Social Security at full retirement age will only replace about 40% of your current income. You are still responsible for replacing roughly 60% of your current income. Everyone’s needs are different however you may need more or less than 100% of your income at retirement and a plan on how to handle the effects of inflation.

My point being, you can’t retire just because you want and it won’t just happen. You must have a plan and be acting on that plan. My question to you is, what are you doing about the other 60%?

If you’d like to discuss your specific situation feel free to call my office at 210-960-7899 or send me an email at jeremy@southtexaswealth.com

Jeremy Sakulenzki is the founder of South Texas Wealth. He's the author of the book: 7 Financial Planning Mistakes Every Baby Boomer Needs To Avoid. Jeremy has a business degree from Texas A&M University and he rarely misses any of their football games. Jeremy's passion lies in helping Baby Boomers protect their retirement saving because he knows there are some things in life you only get one shot at...and retirement is one of them.

Protecting wealth - that's our goal. Putting clients first - that's our guarantee.

- Jeremy Sakulenzki, Founder & CEO